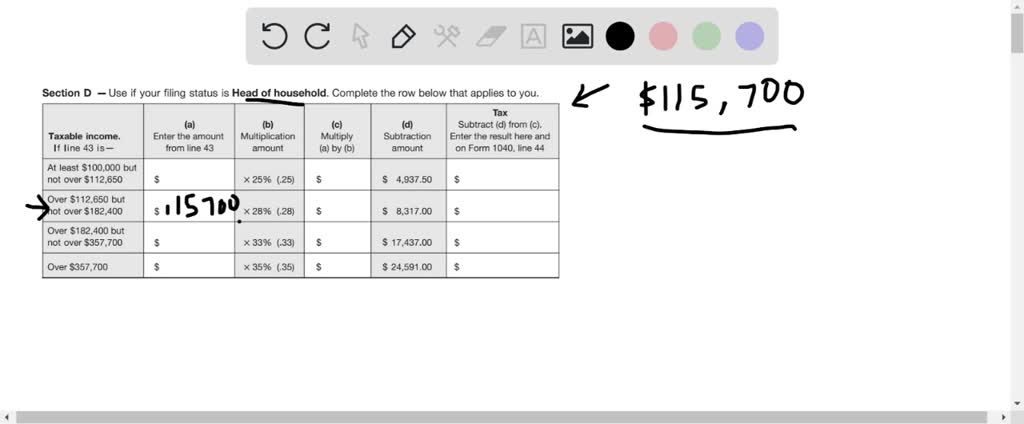

SOLVED:Use this tax computation worksheet to answer Exercises 11–14. table can't copy Calculate the tax using the computation worksheet for a head of household taxpayer with a taxable income of 115,700.

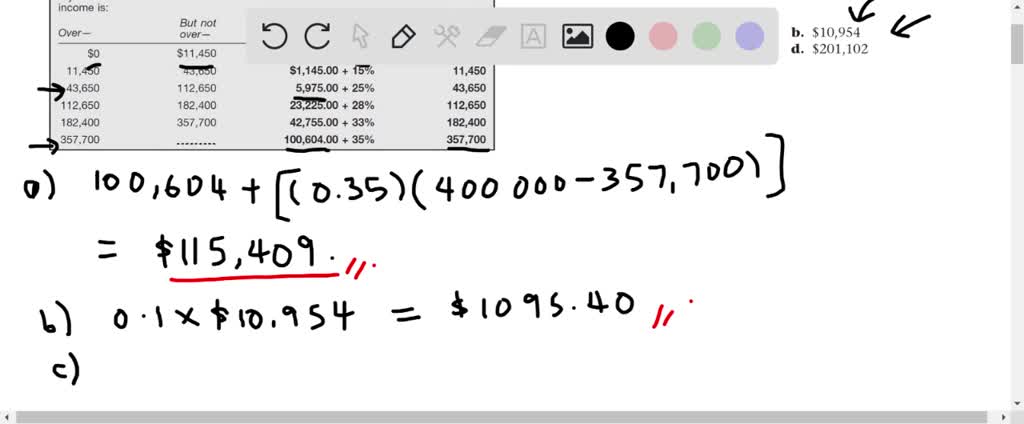

SOLVED:Use this tax computation worksheet to answer Exercises 11–14. table can't copy Let x represent a head of household taxpayer's taxable income that is over 357,700. Write an expression for this taxpayer's

Revised Draft Publication for Computing Withholding by Employers Issued to Go Along with Draft 2020 W-4 — Current Federal Tax Developments

Quiz & Worksheet - Establishing Individuals' Taxpayer Filing Status for Federal Income Tax | Study.com

:max_bytes(150000):strip_icc()/headofhousehold-b7e9af51251b46a7a108a878b7cf2da3.png)

:max_bytes(150000):strip_icc()/w-4formmarriedfilingjointly-b61794485b5e44beab0ee2cfc3c9ae6e.png)

:max_bytes(150000):strip_icc()/Multiple-Jobs-Worksheet-96358d4a739f409d9965ab4359911d3b.jpg)